Coverage & Plans

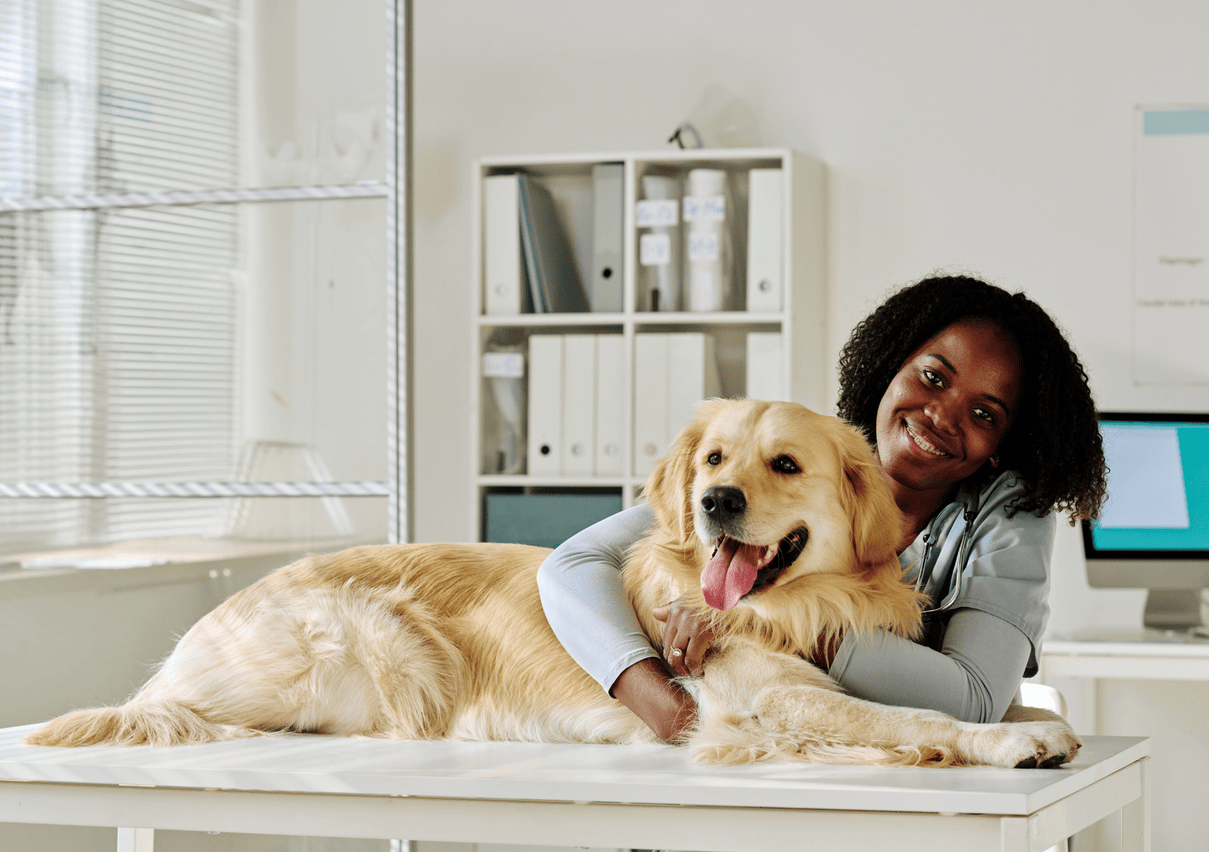

Tailored Protection for Your Pets, Peace of Mind for You

At PawSafi, we understand that your cat or dog is more than just a pet—they’re family. That’s why we offer two simple, flexible insurance plans designed specifically for pet owners in Kenya. Whether you want basic accident cover or complete protection, we’ve got you covered.

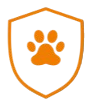

Accident vs Comprehensive

Choose The Cover That Fits Your Pet (and your budget)

Every pet (and owner) is different. Accident Cover delivers affordable peace of mind for those rare, one-off incidents. Comprehensive Cover is broader, like human medical insurance for pets, covering accidents and illnesses, and it includes Wellness for approved preventive care.

At-a-glance:

What Each Plan Covers

What It Covers

All Accident Only benefits plus coverage for illness and additional treatments.

Best For

Owners who want complete peace of mind.

What It Covers

Veterinary costs if your pet is injured in an accident.

Best For

Pet owners seeking affordable, basic protection.

Use the scenarios below to see how each plan responds.

Costs shown are Kenya-based illustrative ranges; your selected annual limits and sub-limits apply.

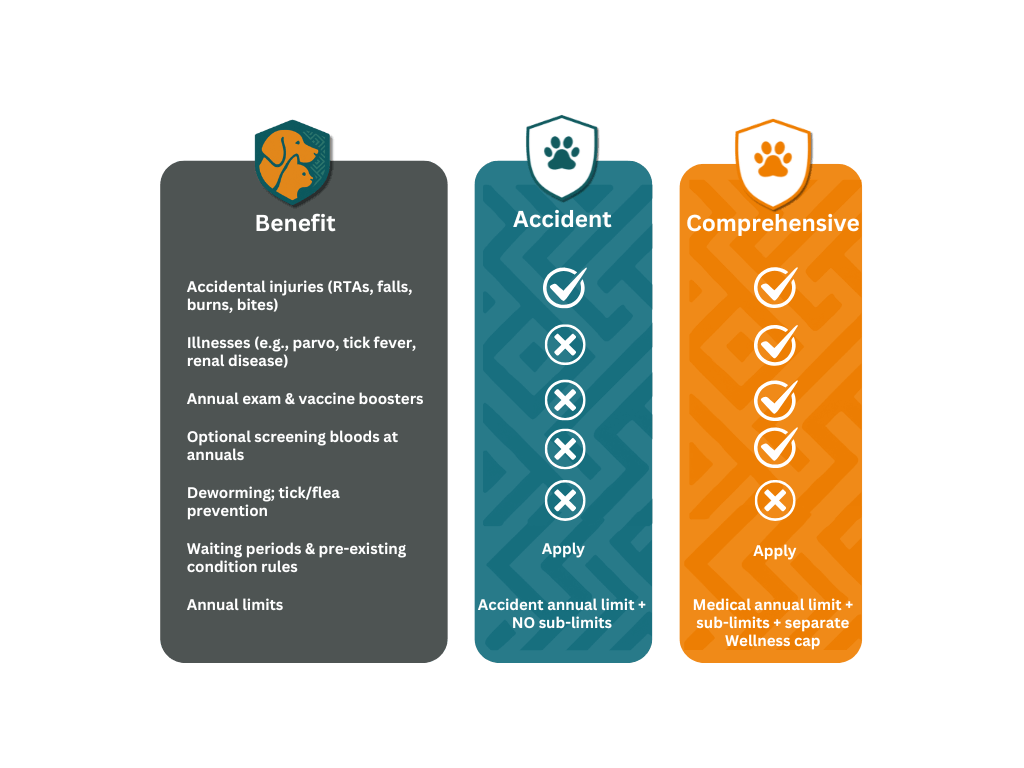

Scenario 1:

Road traffic accident.

This is the kind of shock moment Accident Cover is designed for—sudden injuries that need emergency care, diagnostics and surgery. Both Accident and Comprehensive pay for eligible accidental injuries up to your plan limits. If you want strong protection for the unexpected at a lower monthly premium, Accident Cover is a smart, budget-friendly choice.

A 2-year-old dog is struck by a motorbike and needs emergency care, diagnostics, surgery, and short hospitalisation.

Scenario 2:

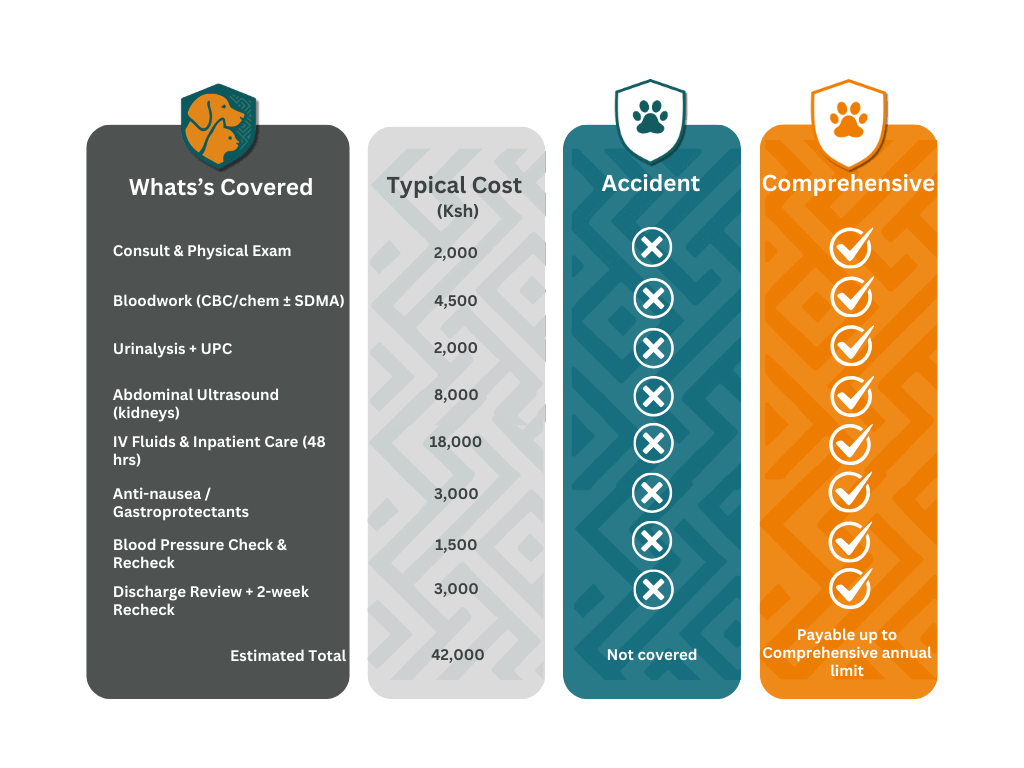

Renal illness (cat with kidney disease)

Illnesses aren’t covered by Accident-only. Comprehensive pays for diagnostics, treatment and follow-ups for covered illnesses—as well as accidents—so you’re protected when health issues develop over time. Wellness (included within Comprehensive) may cover approved screening tests at routine check-ups (early detection), while treatment costs are paid from the medical limit.

A 7-year-old cat presents lethargic and inappetent; admitted for diagnostics and stabilisation. Diagnosis: kidney disease (illness).

Protect Your Pet with the Right Plan

What is the difference between Accident and Comprehensive pet insurance?

Accident Policy covers unexpected injuries—like road traffic accidents, bites, or broken bones.

Comprehensive Policy includes everything in the Accident policy, plus cover for illnesses, diagnostics and ongoing treatments.

What types of pets can be insured?

We currently cover dogs and cats that are at least 8 weeks old and no older than 8 years at the time of sign-up.

Can I visit any vet?

You can visit any of our PawSafi Partner Clinics in Kenya. We are adding to our network regularly and you can also speak to your vet about us if they are not already enrolled.

Is there an excess or co-payment?

No. PawSafi policies have zero excess—we cover 100% of the vet bill (up to your annual benefit limit), making it easier on your wallet when your pet needs care.

How are claims paid?

We Pay the Vet directly.

What’s covered under the Accident Policy?

The Accident Policy covers:

Vet treatment for injuries caused by accidents

Emergency care and surgery

Medication and diagnostic tests related to the accident

Follow-up care for covered accidents

What’s covered under the Comprehensive Policy?

The Comprehensive Policy covers everything in the Accident Policy, plus:

Vet treatment for illnesses and chronic conditions

Diagnostic testing (e.g., bloodwork, X-rays)

Wellness care (e.g., health check-ups and screenings)

Prescription medication

Hospitalisation

(Subject to your plan’s annual benefit limit and sub-limits.)

What is not covered?

Some common exclusions include:

Pre-existing conditions

Elective procedures (e.g., ear cropping)

Breeding or pregnancy-related care

Routine deworming and flea/tick treatment

Cosmetic surgeries

Please refer to the policy documents for a full list of exclusions.

Can I switch between Accident and Comprehensive plans later?

Yes, you can upgrade to a Comprehensive plan at any renewal period. However, any conditions diagnosed before switching may be considered pre-existing and excluded from new cover.

Is there a waiting period?

Yes.

Accident Policy: 48-hour waiting period from the start date.

Comprehensive Policy: 14-day waiting period for illness-related claims.

There is no waiting period for switching plans within the same policy type at renewal.

Are there sub-limits or caps?

Yes. While we pay 100% of the claim up to the annual benefit limit, certain treatment categories (like diagnostics or medication) may have sub-limits. These vary by plan type and tier.

How do I sign up?

You can get a quote and sign up directly on our website. You’ll need your pet’s basic details and your preferred vet clinic. Once approved, coverage starts immediately after the waiting period.

Vet-Approved Protection

At PawSafi, we know that your pet is part of your family. That’s why we’ve designed simple and flexible insurance plans to keep them protected and give you peace of mind. Whether you want essential coverage for unexpected accidents or comprehensive protection for every stage of your pet’s life, PawSafi has a plan to suit your needs.