Accident Only Plan

Affordable Protection for Life’s Unexpected Moments

Accidents can happen at any time, and unexpected veterinary bills can be stressful.

Our Accident Only plan is designed to give you peace of mind, covering the costs if your pet is injured in an accident.

This budget-friendly option ensures your pet receives the care they need without the worry of large, unplanned expenses.

What’s Covered

With the Accident Only plan, you are protected against:

- Injuries from car accidents or road incidents

- Accidental poisoning

- Cuts, wounds, and lacerations

- Bone fractures and dislocations

- Emergency veterinary treatment resulting from an accident

Key Benefits

Our Accident Only plan gives you confidence that your pet is protected from life’s unexpected mishaps.

Designed to cover the most common accidents and emergencies, it ensures your pet can receive prompt veterinary care without leaving you with large, unplanned expenses.

- Affordable Premiums

- Peace of Mind

- Fast & Simple Claims

- Nationwide Vet Network

PawSafi

Accident Insurance Plans

A Quick Note About Our Prices: The prices you see here are just to give you an idea — your pet’s actual premium may vary a little depending on their age and details. For the most accurate and personalised quote, simply get in touch with us or register. We’ll be happy to help you find the best plan for your furry friend! 🐾

- Monthly

- Yearly

Ksh 75,000 Cover

- Ideal for Everyday Emergencies

- This plan is perfect for:

- Pet parents looking for essential protection at an affordable price

- Indoor pets, senior pets, or pets with lower risk of major trauma

- Covering common mishaps like minor fractures, burns, or wounds

Ksh 100,000 Cover

- Extra Cushion for Bigger Bills

- Best for:

- Active or outdoor pets who are more prone to serious injury

- Pet parents who want extra protection for unforeseen emergencies

- Peace of mind when it comes to high-cost procedures like surgeries

Ksh 75,000 Cover

- Key Benefits:

- Covers diagnostic tests, medication, minor surgeries & post-op care

- Fast, direct payment to PawSafi partner vets

- Affordable peace of mind for the most likely accidents

- Annual Payment Option 8% discount on your total premium

Ksh 100,000 Cover

- Key Benefits:

- Perfect if you want a higher safety net without moving to full comprehensive cover.

- Helps cover more intensive or prolonged treatments

- Annual Payment Option 8% discount on your total premium

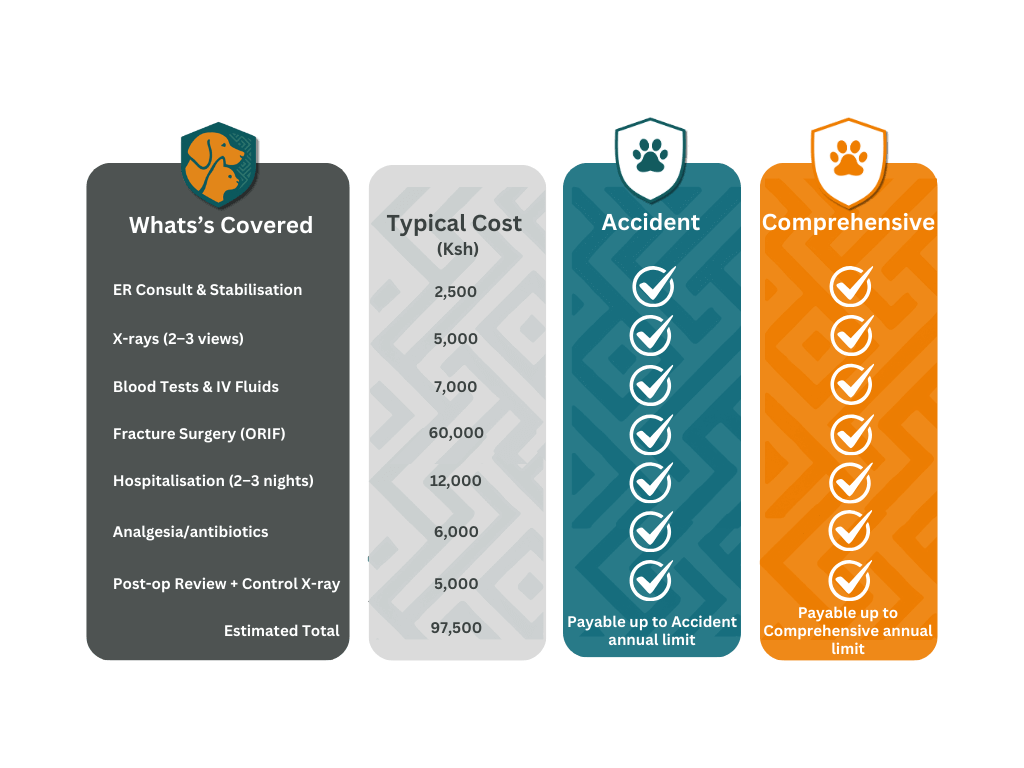

Scenario 1:

Road traffic accident.

This is the kind of shock moment Accident Cover is designed for—sudden injuries that need emergency care, diagnostics and surgery. Both Accident and Comprehensive pay for eligible accidental injuries up to your plan limits. If you want strong protection for the unexpected at a lower monthly premium, Accident Cover is a smart, budget-friendly choice.

A 2-year-old dog is struck by a motorbike and needs emergency care, diagnostics, surgery, and short hospitalisation.

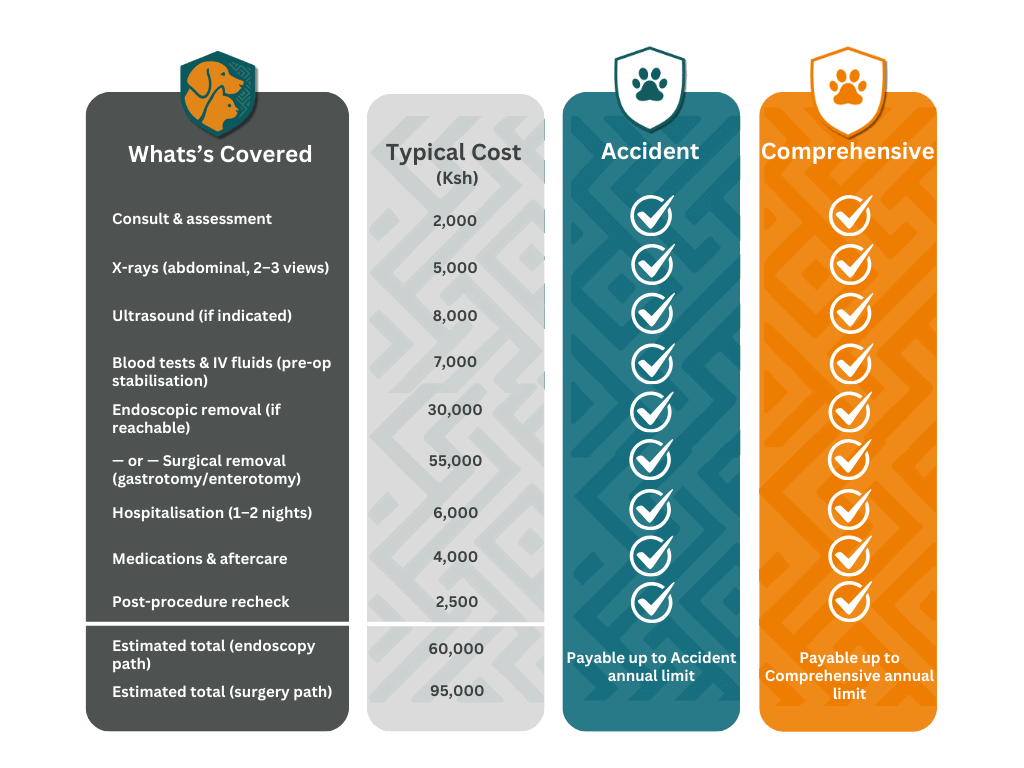

Scenario 2:

Dog swallows a foreign object.

This is a common accident claim—dogs swallow socks, corn cobs, toys, bones, etc. Rapid diagnostics and removal (endoscopy or surgery) prevent life-threatening blockages. Both Accident and Comprehensive cover this accidental injury up to your plan limits.

Protect your pet with our Accident Only plan

Enjoy peace of mind knowing they’re covered

Accidents Covered

Veterinary Costs Paid

Diagnostics & Treatment

Emergency Surgery Covered

Flexible & Affordable

Fast & Hassle-Free Claims

PawSafi

Accident Policy FAQ

The Accident Policy covers vet expenses resulting from unexpected injuries, including:

Road traffic accidents

Cuts, wounds, and broken bones

Burns, electrocution, and choking

Animal fights and snake bites

Swallowed foreign objects

It also includes follow-up treatment, diagnostics, and prescribed medication related to the accident.

No. This policy is designed specifically for accidental injuries. If you're looking for illness coverage, check out our Comprehensive Policy.

No. PawSafi policies are only valid at PawSafi Partner Clinics.

We’re expanding the network regularly, and onboarding new clinics is fast and simple. If your preferred vet isn't yet in our network, feel free to tell them about us or let us know—we’ll do our best to bring them on board.

At our Partner Clinics, PawSafi pays the vet directly—you don’t need to pay out of pocket.

Most claims are settled within 7 working days after receiving all the necessary documentation.

No. There is no excess. PawSafi pays 100% of the covered bill up to the benefit limit for your chosen plan.

There is a 48-hour waiting period for accident coverage after your policy starts. Claims from injuries that happen during this period will not be covered.

Yes. The Accident Policy does not cover:

Pre-existing injuries

Injuries intentionally caused by the owner

Injuries from organised fighting or racing

Cosmetic or elective procedures

For a complete list, please review the full policy document.

Yes. You can upgrade at renewal time. Keep in mind that any injuries or conditions your pet had before switching may be considered pre-existing for illness cover.